Title insurance is a crucial component of the real estate transaction process, providing protection against unforeseen issues that may arise with a property’s title. Whether you’re a homeowner or a prospective buyer, comprehending the coverage and limitations of title insurance is essential. In this guide, we explore the intricacies of title insurance, shedding light on what it covers and, equally importantly, what it doesn’t.

What Title Insurance Covers:

A title insurance policy acts as a safeguard against potential pitfalls in a property’s title that might not have surfaced during the initial purchase. It proves invaluable when the public record search, conducted by the title company, fails to detect liens or ownership disputes. Here are some issues an owner’s title policy can protect against:

1. Property Survey Errors

Title insurance provides a safety net in case of errors in property surveys, ensuring that discrepancies are rectified without causing financial strain on the homeowner.

2. Boundary Disputes

In the event of boundary disputes, where the true limits of a property are contested, title insurance steps in to offer protection and legal assistance.

3. Errors on the Property Deed

Mistakes on property deeds can be rectified with the help of title insurance, preventing potential legal complications.

4. Building Code Violations by Previous Owners

If the previous owner violated building codes, title insurance can shield the new owner from the repercussions and associated costs.

5. Conflicting Wills

In situations involving conflicting wills that impact property ownership, title insurance provides a layer of defense for the homeowner.

6. Claims by an Ex-Spouse

Title insurance safeguards against claims by an ex-spouse who may not have signed off on the property sale, ensuring a smooth ownership transition.

7. Forged Documents

Forgery is a serious concern in real estate. Title insurance protects against forged documents that could compromise the legitimacy of property ownership.

8. Liens from Contractors, Taxing Entities, or Previous Lenders

Title insurance shields against financial encumbrances such as liens from contractors, taxing entities, or previous lenders, offering financial security to the homeowner.

9. Encroachments

In cases of property encroachments, where neighboring structures extend onto the insured property, title insurance provides legal protection and resolution.

10. Improperly Recorded Documents

Errors in recording documents can be rectified with title insurance, ensuring a clear and accurate property title history.

What Title Insurance Does NOT Cover:

While title insurance is a robust safeguard, it does have limitations. It does not protect against infringements on property rights caused by the homeowner’s actions. For instance:

Non-Payment for Services

Title insurance doesn’t cover issues arising from the homeowner’s failure to pay for services, such as roofing replacement or property taxes.

Eminent Domain

Title insurance doesn’t protect against eminent domain, where the government seizes private property for public purposes.

2 Types of Title Insurance

1. Lender’s Title Insurance (Loan Policy)

This type protects the financial interests of the lending institution, ensuring they have the top claim on the property. It is mandatory when obtaining a mortgage.

2. Owner’s Title Insurance

This policy protects the homebuyer, with coverage typically equal to the purchase price. It is optional but highly recommended for comprehensive protection.

How Title Insurance Works

An owner’s title insurance policy operates by covering the costs associated with undiscovered liens or legal challenges to property ownership. It can provide financial assistance for resolving issues or even offer a cash settlement to the owner. Importantly, it safeguards the ability to sell the property in the future, should a problem arise during a subsequent title search.

For lender’s title insurance, it ensures the lender is compensated if the homeowner faces issues that lead to a failure to repay the mortgage. In case of fraudulent property sale, the lender can file a claim to recoup the expected mortgage payments.

Understanding the nuances of title insurance empowers homeowners and buyers alike, offering peace of mind in the complex landscape of real estate transactions.

5 Parts of the Title Insurance Policy

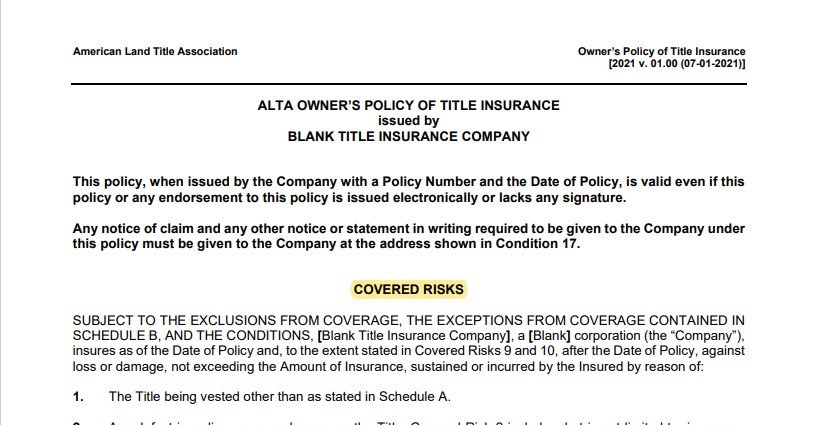

Covered Risks Owners Policy Of Title Insurance

5. Conditions

This section elucidates the relationship between the insured party and the title company. Paragraph 1 serves to define key terms used in the policy, including “Insured,” “Insured Claimant,” “Knowledge,” and “Public Records,” with the aim of eliminating any potential ambiguity. Numerous paragraphs detail the procedures for handling a claim under the policy, encompassing aspects such as providing notice of a claim, the evidentiary requirements for proving loss, and the imperative for the insured to cooperate with the title company in managing the claim. Further details on filing a claim can be found here. The Conditions delineate the title company’s rights to pay or settle the claim, along with specifications on the determination, extent, and limitation of liability. Additionally, many policies include a paragraph permitting either the insured or the title company to initiate arbitration if the amount in question is below $2 million.

Conclusion:

In the intricate realm of real estate transactions and closing costs, title insurance emerges as a pivotal shield against unforeseen challenges. From property survey errors to forged documents, it offers a safety net. Delving into covered risks, exclusions, and policy details, this comprehensive guide empowers you to comprehend the intricacies of title insurance fully. Navigate with confidence, ensuring a secure and informed journey in the dynamic landscape of property ownership.