History of Property Taxes

Property taxes have played a crucial role in financing the United States government since the nation’s inception. During the 18th and 19th centuries, when property ownership was commonly associated with wealth, property taxes functioned as a predominantly progressive tax.

While the federal government and the majority of state governments have shifted away from relying on property taxes to fund their operations, this is partly due to the diminishing connection between property ownership, wealth, and the ability to pay. Despite this shift, property taxes remain a significant revenue source for local governments. In 40 U.S. states, the primary income for local governments is derived from property taxes, as reported by the Pew Research Center.

This persistence is observed despite an increasing body of research questioning the equitable distribution of the overall property tax burden, the fair allocation of generated revenue, and whether the enforcement of tax payments, particularly through the sale of delinquent taxes, disproportionately affects individuals of color.

In Illinois, these inquiries have taken center stage in property tax debates over recent decades, prompting the implementation of restrictions on property tax increases, enhanced tax exemptions for owner-occupied homes, a restructuring of the Cook County property tax assessment system, and modifications to the state’s approach to distributing public school funding. These changes aim to foster greater equity in educational opportunities between wealthier and poorer communities. If you are already a homeowner, or in the market to buy a home, this guide will help explain how property taxes in Illinois (Cook County) are collected.

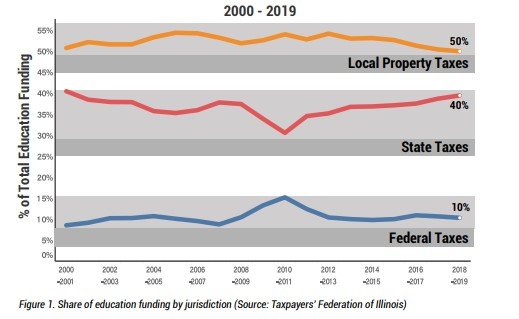

School Funding Through Property Taxes, State Taxes, and Federal Taxes

2 Most Common Methods of Property Tax Collection

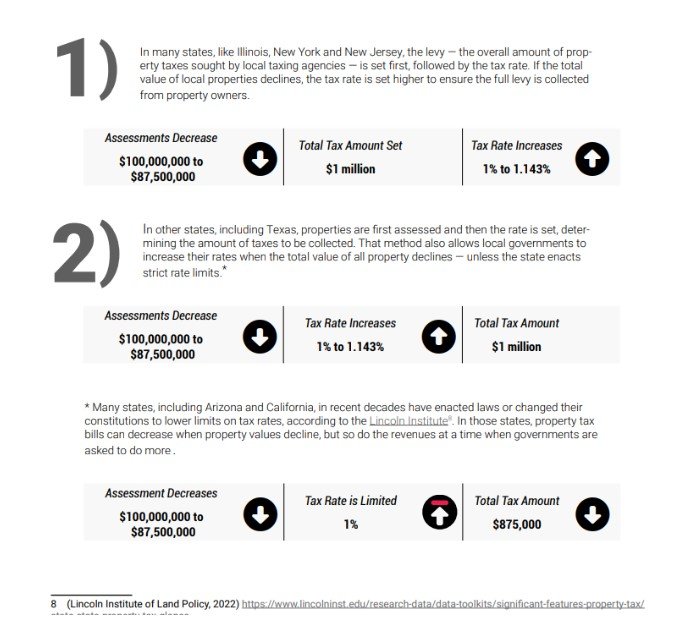

Property tax systems in the United States exhibit variations from one state to another, and even within locales. However, as a general rule, there are two primary methods by which property taxes are determined across the country.

The Cook County Property Tax Procedure

Determining the property tax amounts for billing is a multifaceted and extensive process that spans several months and involves at least six government agencies (refer to the chart on the next page for details). The outcomes of decisions made by these agencies ultimately dictate the billing amount for each property owner. The subsequent pages provide a comprehensive overview of the entire process, starting from establishing property values to the issuance of bills and the enforcement of collection.

Step 1: Assessments

Assessments play a pivotal yet frequently misunderstood role in the property tax process. These assessments, which are estimates of a property’s market value, determine the proportion of the overall property tax burden that falls on each individual property owner within a jurisdiction.

For instance, if a property’s assessed value constitutes one-tenth of 1% of the total assessed value within a taxing jurisdiction, the owner of that property is accountable for one-tenth of 1% of the overall tax burden. To illustrate, if the total tax burden in the local jurisdiction amounts to $1 million, the hypothetical property owner would be required to pay $1,000.

It’s essential to note that an increased assessment alone does not necessarily indicate a tax increase. Several scenarios illustrate this point:

- If a property’s assessment rises at the same rate as other properties in a taxing district, and local governments do not augment the property tax levy, the property’s tax bill will remain constant.

- If a property’s assessment increases but by a lower percentage than other properties in the taxing district, and local governments do not raise their property tax levy, the property’s tax bill will decrease.

- If a property’s assessment experiences a greater percentage increase than other properties in the taxing district, the property’s tax bill will rise, even if local governments do not escalate their property tax levy.

In Illinois, county and township assessors establish the value of nearly all properties based on the “fair cash value,” reflecting the property’s potential sale price on the open market. The Illinois Department of Revenue assesses certain properties, such as railroad properties and pollution-control facilities, using different methodologies. In most Illinois counties, except Cook County, the final assessment level is 33⅓% of fair cash value. However, in Cook County, vacant parcels and residential properties, including apartment buildings, are assessed at 10% of fair cash value, while businesses and industries are assessed at 25% of fair cash value. Consequently, a commercial property with an equivalent market value as a home would be taxed two-and-a-half times more than the home.

These assessment differentials, aimed at alleviating the burden on homeowners and renters, have been in practice since before 1970 and were expressly permitted in the Illinois Constitution. Consequently, Chicago exhibits one of the highest effective commercial and industrial property tax rates compared to cities nationwide, as reported by the Lincoln Institute and the Minnesota Center for Fiscal Excellence.

Step 2 — Appeals

After the assessment process is finished, property owners receive notification of the new assessment values. Subsequently, property owners have a 30-day window to initiate an appeal (challenge) at their Assessor’s Office. The appeal process varies, being informal in some jurisdictions and entailing a formal written process in others. Typically, to succeed in an appeal, a homeowner needs to demonstrate that their property was assessed at a higher value than comparable properties. Businesses also have the option to contest their assessments, utilizing comparisons, occupancy levels, and income generation.

Should the property owner choose not to appeal to the assessor or remain dissatisfied with the assessor’s decision, they can file an appeal with the county Board of Review. If the property owner remains unsatisfied with the Board of Review’s decision, they have two further options: appealing to the state Property Tax Appeal Board or to a county Circuit Court. The appeal process with the Appeals Board often extends over several years, and Circuit Court proceedings can be lengthy in certain counties. Consequently, property owners generally have to fulfill their tax obligations based on the contested assessment while the appeal is ongoing (refer to Figure 6).

It’s crucial to acknowledge that studies in the press and academia have concluded that the appeals process frequently exacerbates the regressive nature of the property tax system. This is attributed to the fact that wealthier property owners typically have greater resources to mount successful appeals.

Step 3 — Equalization

The Illinois Department of Revenue utilizes property assessed values to compute state funding for schools, highways, and public assistance, while also determining tax and borrowing limitations within taxing jurisdictions. This is because these limitations are partially based on the assessed values within each jurisdiction, with property tax-rich districts receiving less state funding.

However, the calculations for state funding would lack fair and equitable distribution if the state did not adjust the assessment results produced by assessors across its 102 counties. Cook County assesses properties at different percentages of fair cash value compared to the rest of the state, and some assessors may under- or overvalue properties within their jurisdictions.

Moreover, the state is obligated to ensure an equal distribution of the property tax burden among property owners throughout Illinois. This can only be achieved if all assessments reflect the same percentage of fair cash value.

To achieve uniformity, the Illinois Department of Revenue “equalizes” assessments across the state to a standard of 33⅓% of fair cash value. This involves conducting an “assessment/sales ratio study” that compares a sample of assessments to actual sales, evaluating the accuracy of assessments while accounting for differing percentages of assessed values.

In counties outside Cook County, where assessors aim to value all property at 33⅓%, adjustments are only necessary when assessments deviate from this target, as determined by the assessment/sales ratio study. If assessments in a county or township align with the 33⅓% mark, they are multiplied by 1, indicating no change. However, if they fall short of 33⅓%, they are multiplied by a slightly greater number. For instance, in DuPage County, Illinois’ second-largest county, the multiplier for bills issued in 2021 was 1.034.

Step 4 — Establishing the Levy

In Illinois, numerous governing bodies, including school districts, municipalities, townships, park districts, and library districts, determine the annual amount they need to collect from property taxes, a process referred to as “setting the levy.”

The levies set by these local taxing districts play a decisive role in determining whether overall taxes increase or decrease. In a hypothetical scenario where everyone’s assessment increased by the same percentage in a given year alongside an overall levy increase, taxes would rise for every property. However, since assessments typically rise by varying amounts, the impact of an overall tax increase varies among property owners.

While there are state-imposed limits on how much a taxing jurisdiction can levy, these limits generally restrain increases rather than reducing the overall tax burden. The most significant limit is imposed by the Illinois Property Tax Extension Limitation Law, commonly known as the tax cap. This law restricts tax increases in non-home rule units of government to 5% or the preceding year’s increase in the national Consumer Price Index, whichever is less.

It’s important to note that although the Limitation Law applies to all Illinois school districts, accounting for over half the overall property tax burden, it does not extend to home rule municipal governments. Home rule municipalities, which have greater independence in governing decisions, including taxation, are not bound by the same restrictions. In Cook County, 84 out of 135 municipalities possess home-rule powers.

A municipality attains home rule authority when its population exceeds 25,000, or voters in a referendum decide to grant home rule status. Home rule authority can also be revoked by voter referendum.

Once local governments vote to approve their budgets and set their levies, the levy amounts are transmitted to the County Clerk for implementation.

Step 5 — Extending the Levy

The County Clerk plays a crucial role in ensuring that the levies submitted by each government adhere to the limits set by the tax cap law. The Clerk also incorporates the equalization factor into the final assessed values before the Assessor applies any exemptions.

Once the exemptions are accounted for, the Clerk calculates the “adjusted equalized assessed value” using the following formula:

The Clerk then ensures that the rates for each district do not surpass the maximum amounts allowed by state law for each taxing agency. After confirming compliance, the Clerk totals the rates applicable to each individual property in the county.

The outcome is the “aggregate rate,” commonly known as the “composite rate.” This aggregate rate is then multiplied by the assessed value of each property to determine the amount of tax owed:

Collection and Distribution:

The Treasurer uses the data provided by the Clerk to prepare the tax bills, which offer a detailed breakdown of how much each property owner is being billed by the governments that serve them. The bills are mailed in two installments. (Figure 8)

3 Most Common Homeowner Property Tax Exemptions For Cook County:

- General Homestead Exemption

- Senior Citizens Homestead Exemption

- Senior Citizens Assessment Freeze Homestead Exemption

General Homestead Exemption

This exemption is accessible to every homeowner for their primary residence and is the most widespread. It reduces a property’s equalized assessed value by $10,000 in Cook County and $6,000 in the rest of the state.

Senior Citizens Homestead Exemption

Available to homeowners aged 65 and older for their primary residence, this exemption leads to an $8,000 reduction in equalized assessed value in Cook County and $5,000 in the rest of the state.

Senior Citizens Assessment Freeze Homestead Exemption

Homeowners aged 65 or above with an annual household income of less than $65,000 can apply for this exemption. The assessed value of the home remains frozen at the level it held when the exemption was initially granted. This results in lower tax bills even as other property assessments increase over time.

Additional potential assessment reductions are available for various types of homeowners.

Chicago Has Second Highest Tax Rate in The United States

A recent investigation conducted by the Lincoln Institute of Land Policy reveals that Chicago presently claims the second-highest burden of commercial property taxes nationwide. The exorbitant costs primarily emanate from governmental expenditures and the resultant elevated taxes, cascading down to tenants in the guise of augmented rental fees. Only Detroit surpasses this fiscal imposition. Registering at 3.78 percent, commercial property levies throughout the city soar beyond twice the U.S. mean for the foremost cities in each state. Over the preceding decade, the cumulative tax assessment within the city has surged from $1.98 billion in the tax year 2011 to a staggering $3.82 billion, signifying a formidable 93% escalation during this period. In Central Illinois, businesses of substantial scale contend with an average annual commercial tax approaching $150,000

Pension Liabilities:

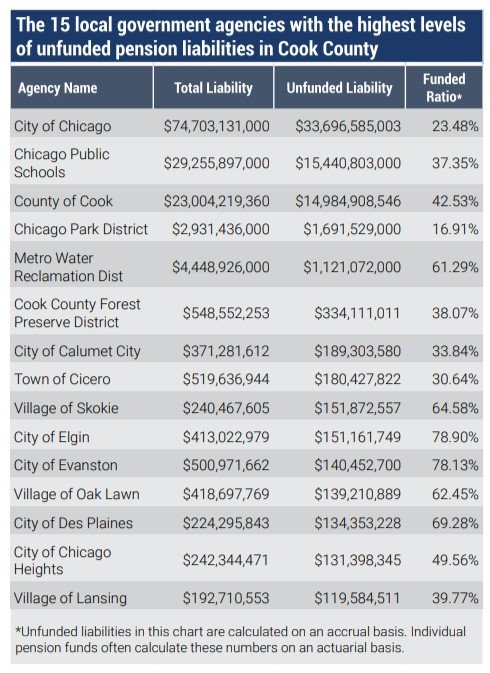

Numerous municipalities throughout Illinois face some of the most significant unfunded pension obligations in the United States. This situation may lead to substantial tax hikes as local governments and counties implement measures to adhere to a state law requiring local pension funds to attain 90% funding in the upcoming decades.

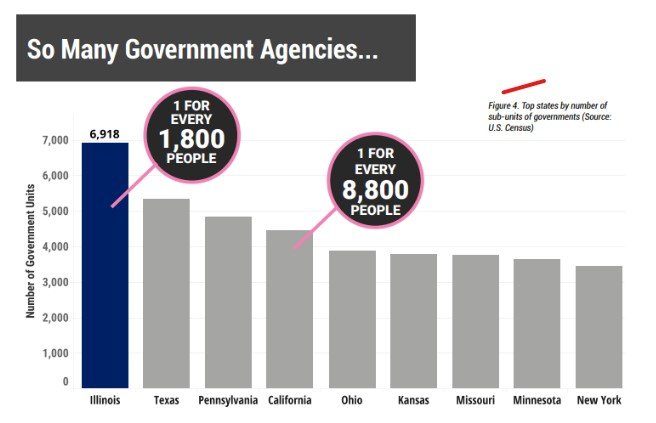

Too Many Government Agencies

Another contributing factor to the heightened overall cost of local government in Illinois stems from the exceptionally large number of local governments in the state. Both the U.S. Census Bureau and the Civic Federation government budget watchdog group conducted surveys revealing that Illinois surpasses all other states in the union in terms of its abundance of local governments. Each of these entities maintains its own bureaucracy, thereby increasing the financial burden on taxpayers (see Figure 4).

Local governments in Illinois often heavily depend on property taxes due to their generally stable collection amounts. When the economy faces challenges, the other primary sources of revenue for local governments—sales taxes and local income taxes (which Illinois lacks)—tend to decrease. Unlike property taxes in many states, which remain unaffected by economic downturns due to their predetermined nature, local government property tax levies in Illinois are determined after budget formulation, irrespective of fluctuations in property values. In contrast, sales and income taxes, fixed at specific percentages, experience variations in receipts based on the financial well-being of consumers.

Conclusion:

In tracing the evolution of property taxes in Illinois, it becomes evident that these levies, rooted in history, have weathered the tides of change but remain a pivotal revenue stream for local governments. The intricate process of property tax collection in Illinois, exemplified by the Cook County procedure, underscores the multifaceted nature of this system. While efforts have been made to address issues of equity and transparency, challenges persist, especially in the realm of appeals and equalization. As the state grapples with these complexities, it is crucial to recognize the impact of property taxes on education, local governance, and the broader fiscal landscape. The three common homeowner exemptions in Cook County offer a glimpse into the strategies employed to alleviate the burden on specific demographics. However, challenges such as Chicago’s high commercial tax rates, pension liabilities, and the proliferation of government agencies add layers of complexity to the property tax landscape in Illinois. Navigating these challenges requires a nuanced approach that balances the need for revenue with the imperative of fairness and inclusivity.