Are you considering a move to the Windy City as it leads the nation in home price growth? Whether you’re attracted by job opportunities, cultural diversity, or the city’s unique blend of urban and lakeside living, one of the most important factors to consider is the cost of living Chicago IL. Dive into the world of Chicago’s living costs, to get a better understanding of how Chicago compares to other major cities. From the towering condos of River North, single family homes in Lincoln Park, or the eclectic vibe of up-and-coming neighborhoods like Logan Square and Wicker Park, understanding the cost of living in Chicago, Illinois, is crucial for making an informed decision about your next big move.

Understanding Chicago’s Cost of Living

Chicago, with its vibrant arts scene, diverse culinary landscape, and iconic architecture, beckons to many. But residing in this vibrant city is not without its expenses. The cost of living in Chicago is slightly more expensive than the rest of the country, with a living index of 105.7. This figure is influenced by various factors, such as:

- Housing

- Transportation/Gas

- Food

- Utilities

These factors combine to create the four estimated monthly costs of living in the city, as determined by a cost of living calculator.

Particularly, the cost of housing significantly influences Chicago’s living expenses. Whether renting or owning, the cost of a home can be a major player in your monthly budget, a crucial element to consider while planning your relocation to the city.

Housing Costs: Single Family Homes and Condos

The housing market in Chicago offers a wide range of options, from luxury condo buildings in the heart of the city to comfortable single family homes in the suburbs.

Condo Price Index Chicago

The median home price in Chicago area ($350,000) is slightly below the national median ($387,000). Although this might seem steep compared to other parts of the country, it’s lower than cities like San Francisco and New York, where median home prices can be more than double.

Transportation Expenses: Public Transit and Car Ownership

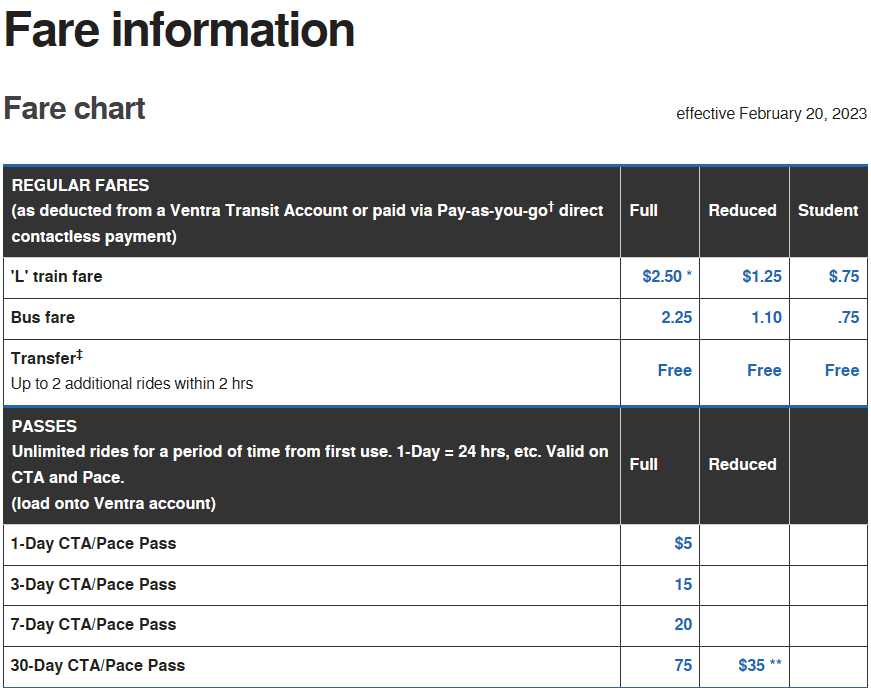

Thoughtful consideration of transportation costs is required when navigating through the bustling streets of Chicago. The city’s extensive public transportation system, with its ‘L’ elevated railway and bus network, provides an affordable and convenient means of getting around. Here are the prices for different modes of transportation:

- A single ride on the ‘L’ costs $2.50

- A bus ticket is priced at $2.25

- Regular commuters can take advantage of a monthly pass that covers both the ‘L’ and bus services for $75

Car ownership in Chicago brings along its unique expenditure. However, it also provides convenience and flexibility in transportation. From annual auto insurance costs ranging between $672 and $1,212, to the city’s Wheel Tax, which requires car owners to purchase a Chicago City Vehicle Sticker costing between $90.88 to $144.33, car ownership can significantly impact your monthly budget.

Average Cost of Gas (cost per gallon/3.785 liters) in the Chicago Area

Consumer Price Index Chicago Area

The Consumer Price Index (CPI) is a widely used economic indicator that measures changes in the average prices paid by consumers for a basket of goods and services over time. It is often used to gauge inflation or deflation and is an essential tool for economists, policymakers, businesses, and the general public to understand the overall price level in an economy.

Here’s how the CPI works:

- Basket of Goods and Services: The CPI starts by selecting a representative “basket” of goods and services that an average urban consumer typically purchases. This basket includes items like food, clothing, housing, transportation, healthcare, entertainment, and more.

- Price Data Collection: Government agencies or statistical organizations regularly collect price data for these items from various regions and outlets. They record the prices of these items at different times to track changes.

- Calculation: The CPI is calculated by comparing the cost of the basket of goods and services in a given period (typically a month or a year) to the cost of the same basket in a base period (usually a specific year, which is set as the reference point with a CPI value of 100). The formula for calculating the CPI is as follows:CPI = (Cost of Basket in Current Period / Cost of Basket in Base Period) x 100

- Index Values: The CPI is expressed as an index number. When the CPI is above 100, it indicates that prices have risen compared to the base period, suggesting inflation. Conversely, when the CPI is below 100, it suggests deflation or falling prices.

- Inflation Measurement: Economists and policymakers use changes in the CPI over time to assess the rate of inflation. A rising CPI indicates increasing prices, while a falling CPI suggests decreasing prices.

The CPI has several variations and sub-indices, such as the Core CPI, which excludes volatile food and energy prices to provide a more stable measure of inflation. It is important because inflation can have significant effects on an economy, affecting the purchasing power of consumers, interest rates, investment decisions, and more.

Governments and central banks often use CPI data to make decisions about monetary policy, including setting interest rates, and to adjust government benefits, tax brackets, and other economic policies in response to changing price levels. It is also a useful tool for individuals and businesses to track how inflation may impact their expenses and financial planning.

Comparing Chicago to Other Major Cities

Having explored the primary components of Chicago’s cost of living, it’s imperative to contextualize these numbers through comparison with other major cities. Although Chicago is a major city and the third-largest in the U.S. by population, it ranks 37th in terms of cost of living. This indicates that while the city offers an urban lifestyle similar to places like New York and Los Angeles, it does so at a comparatively lower cost.

Salaries and Job Opportunities in Chicago

Per Capita Income in Chicago Area

While the cost of living in Chicago is relatively affordable compared to other big cities, it’s important to consider income potential as well. The average salary in the Chicago area is slightly above $70,000 per year, which, depending on your profession and level of experience, could stretch further in Chicago than in more expensive cities.